False0001101239DEF 14A00011012392023-01-012023-12-31iso4217:USDxbrli:pure000110123922023-01-012023-12-3100011012392022-01-012022-12-31000110123922022-01-012022-12-3100011012392021-01-012021-12-31000110123922021-01-012021-12-3100011012392020-01-012020-12-31000110123922020-01-012020-12-310001101239ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-01-012023-12-310001101239ecd:EqtyAwrdsAdjsMemberecd:PeoMember2023-01-012023-12-310001101239ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2022-01-012022-12-310001101239ecd:EqtyAwrdsAdjsMemberecd:PeoMember2022-01-012022-12-310001101239ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2021-01-012021-12-310001101239ecd:EqtyAwrdsAdjsMemberecd:PeoMember2021-01-012021-12-310001101239ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2020-01-012020-12-310001101239ecd:EqtyAwrdsAdjsMemberecd:PeoMember2020-01-012020-12-310001101239ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2023-01-012023-12-310001101239ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-01-012023-12-310001101239ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2023-01-012023-12-310001101239ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2023-01-012023-12-310001101239ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2023-01-012023-12-310001101239ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2022-01-012022-12-310001101239ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2022-01-012022-12-310001101239ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2022-01-012022-12-310001101239ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2022-01-012022-12-310001101239ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2022-01-012022-12-310001101239ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2021-01-012021-12-310001101239ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2021-01-012021-12-310001101239ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2021-01-012021-12-310001101239ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2021-01-012021-12-310001101239ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2021-01-012021-12-310001101239ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2020-01-012020-12-310001101239ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2020-01-012020-12-310001101239ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2020-01-012020-12-310001101239ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2020-01-012020-12-310001101239ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2020-01-012020-12-310001101239ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2020-01-012020-12-310001101239ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001101239ecd:NonPeoNeoMemberecd:EqtyAwrdsAdjsMember2023-01-012023-12-310001101239ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001101239ecd:NonPeoNeoMemberecd:EqtyAwrdsAdjsMember2022-01-012022-12-310001101239ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001101239ecd:NonPeoNeoMemberecd:EqtyAwrdsAdjsMember2021-01-012021-12-310001101239ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2020-01-012020-12-310001101239ecd:NonPeoNeoMemberecd:EqtyAwrdsAdjsMember2020-01-012020-12-310001101239ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2023-01-012023-12-310001101239ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2023-01-012023-12-310001101239ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2023-01-012023-12-310001101239ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2023-01-012023-12-310001101239ecd:NonPeoNeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2023-01-012023-12-310001101239ecd:NonPeoNeoMemberecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMember2023-01-012023-12-310001101239ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2022-01-012022-12-310001101239ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2022-01-012022-12-310001101239ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2022-01-012022-12-310001101239ecd:NonPeoNeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2022-01-012022-12-310001101239ecd:NonPeoNeoMemberecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMember2022-01-012022-12-310001101239ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2021-01-012021-12-310001101239ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2021-01-012021-12-310001101239ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2021-01-012021-12-310001101239ecd:NonPeoNeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2021-01-012021-12-310001101239ecd:NonPeoNeoMemberecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMember2021-01-012021-12-310001101239ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2020-01-012020-12-310001101239ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2020-01-012020-12-310001101239ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2020-01-012020-12-310001101239ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2020-01-012020-12-310001101239ecd:NonPeoNeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2020-01-012020-12-310001101239ecd:NonPeoNeoMemberecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMember2020-01-012020-12-31000110123912023-01-012023-12-31000110123932023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

Equinix, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | | | | |

| EQUINIX 2024 PROXY STATEMENT | |

| | |

|

Notice of Annual Meeting

of Stockholders |

|

| | | | | | | | | | | | | | |

Dear Stockholder: You are cordially invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of Equinix, Inc., a Delaware corporation (“Equinix”). This year’s meeting will be held exclusively online; we are not holding an in-person meeting. The Annual Meeting will be held on Thursday, May 23, 2024, at 9:00 a.m. PDT, and login will begin at 8:45 a.m. PDT. We believe in meaningfully engaging with our stockholders and hope this virtual meeting will maximize participation. You will be able to attend and participate in the virtual Annual Meeting, vote your shares electronically and submit your questions during the meeting by visiting: www.virtualshareholdermeeting.com/EQIX2024 To participate in the virtual meeting, you will need the 16-digit control number included on your Notice of Internet Availability of Proxy Materials, proxy card, or voting instruction form. Please refer to the “Voting Information and Attending the Meeting” section of the proxy statement for more details about attending the Annual Meeting online. Beneficial stockholders who did not receive a 16-digit control number from their bank or brokerage firm, who wish to attend the meeting, should follow the instructions from their bank or brokerage firm, including any requirement to obtain a legal proxy. Most brokerage firms or banks allow a stockholder to obtain a legal proxy either online or by mail. Formal rules of conduct and technical support will be available during the virtual Annual Meeting. We encourage you to access the meeting prior to the start time leaving ample time for the check-in. Please follow the registration instructions as outlined in this proxy statement. At the Annual Meeting, the following proposals will be considered and voted on, in addition to such other business as may properly come before the meeting or any adjournments or postponements thereof: | | | | |

| TO BE HELD Thursday, May 23, 2024

9:00 a.m. PDT | |

| | |

| VIRTUAL MEETING www.virtualshareholder meeting.com/EQIX2024 | |

| | |

| ATTENDANCE Whether or not you plan to attend the Annual Meeting, please vote promptly, following the instructions contained in the materials you received. | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| ITEMS OF BUSINESS |

|

| | | | | | | | | | | | |

| PROPOSAL | | BOARD’S

RECOMMENDATION | | SEE PAGE |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| 1 | Election of directors to the Board of Directors (the “Board”) to serve until the next Annual Meeting or until their successors have been duly elected and qualified: | | | | FOR each nominee | | |

| | Nanci Caldwell Adaire Fox-Martin | Gary Hromadko Charles Meyers | Thomas Olinger Christopher Paisley | Jeetu Patel Sandra Rivera | Fidelma Russo Peter Van Camp | | | | | | |

| | | | | | | | | | | | |

| 2 | Approval, by a non binding advisory vote, of the compensation of our named executive officers | | | | FOR | | |

| 3 | Approval of the Amendment of the Equinix, Inc. 2004 Employee Stock Purchase Plan (the “Plan”), including to eliminate the Plan termination date | | | | FOR | | |

| 4 | Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending Dec. 31, 2024 | | | | FOR | | |

| | | | | |

| EQUINIX 2024 PROXY STATEMENT | |

| | | | | | | | |

| | |

The foregoing items of business are more fully described in the attached proxy statement. Only stockholders of record at the close of business on Mar. 26, 2024, are entitled to notice of, and to vote at, the Annual Meeting and at any adjournments or postponements thereof. | | BY ORDER OF THE BOARD OF DIRECTORS, Peter Van Camp

Executive Chairman

Redwood City, California

Apr. 12, 2024 |

| | | | | |

| |

| Whether or not you plan to attend the virtual meeting, please vote as soon as possible. |

| |

You may revoke your proxy at any time prior to the Annual Meeting. If you decide to attend the virtual Annual Meeting and wish to change your proxy vote, you may do so by attending the Annual Meeting webcast.

| | | | | |

| |

| Important notice regarding the availability of proxy materials for the Annual Meeting to be held on May 23, 2024. The proxy statement and annual report to stockholders on Form 10-K are available at: https://investor.equinix.com/news-events/annual-meeting-of-stockholders |

| |

| | |

|

| VOLUNTARY E-DELIVERY OF PROXY MATERIALS |

|

|

We encourage our stockholders to enroll in electronic delivery of proxy materials. |

Electronic delivery offers immediate and convenient access to proxy statements, annual reports and other investor documents. It also helps us preserve the environment and reduce printing and shipping costs. |

Visit proxyvote.com to vote your shares and, when prompted, indicate that you agree to receive or access proxy materials electronically in future years. |

|

PROXY STATEMENT

Table of contents

| | | | | | | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Section 16(A) beneficial ownership reporting compliance | 29 |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | | | | |

| EQUINIX 2024 PROXY STATEMENT | Proxy Summary / 1 |

These proxy materials are provided in connection with the solicitation of proxies by the Board of Directors of Equinix, Inc., a Delaware corporation, for the Annual Meeting of Stockholders to be held on May 23, 2024, and at any adjournments or postponements of such meeting. These proxy materials were first sent on or about April 22, 2024, to stockholders entitled to vote at the Annual Meeting. This summary highlights some of the topics discussed in this proxy statement. It does not cover all the information you should consider before voting, and you are encouraged to read the entire proxy statement before casting your vote.

General information

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | |

| WHEN Thursday, May 23, 2024

9:00 a.m. PDT | | VIRTUAL LOCATION Visit: www.virtualshareholdermeeting.com/

EQIX2024 | | | RECORD DATE Mar. 26, 2024 | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| CORPORATE INFORMATION | | | EQUINIX WEBSITES | |

| Stock Symbol EQIX | | | Registrar & Transfer Agent Computershare | | | CORPORATE WEBSITE Equinix.com INVESTOR RELATIONS investor.equinix.com 2024 ANNUAL MEETING MATERIALS https://investor.equinix.com/news-events/annual-meeting-of-stockholders PUBLIC POLICY ACTIVITIES https://investor.equinix.com/board-governance/public-policy-activities | |

| | | | | | | |

| | | | | | | |

| Stock Exchange NASDAQ | | | State of Incorporation Delaware | | | |

| | | | | | | |

| | | | | | | |

| Common Stock Outstanding

As of Mar. 26, 2024 94,904,205 shares | | | Year of Incorporation 1998 | | | |

| | | | | | | |

| | | | | | | |

| | | | Public Company Since 2000 | | | |

| | | | | | | | |

| | | | | |

| EQUINIX 2024 PROXY STATEMENT | Proxy Summary / 2 |

Voting

Have your proxy card or voting instruction form in hand when voting by telephone or online. When voting, you will need to enter the unique 16-digit voter control number imprinted on the card or instruction form.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| | | | | REGISTERED HOLDERS (shares are registered in your own name) | | | BENEFICIAL OWNERS (shares are held “in street name” in a stock brokerage account or by a bank, nominee or other holder of record) | |

|

| | | | | | | | | | |

| | BY MOBILE DEVICE | | | Scan the QR code provided on your proxy card | | | Scan the QR code if one is provided by your broker, bank or other nominee | |

| | | | | | | | | | |

| | | | | | | | | | |

| | BY INTERNET | | | Vote your shares online 24/7 at

proxyvote.com | | | Vote your shares online 24/7 if a website is provided by your broker, bank or other nominee | |

| | | | | | | | | | |

| | | | | | | | | | |

| | BY TELEPHONE | | | Call toll-free 24/7 in the U.S., U.S. territories and Canada 1-800-690-6903 | | | Call the toll-free number provided on your voting information form 24/7 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | BY MAIL | | | Complete, date, sign and return your proxy card in the postage-paid envelope | | | Complete, date, sign and return your voting information form | |

| | | | | | | | | | |

Items to be voted on and our Board’s recommendation

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| PROPOSAL | | BOARD’S

RECOMMENDATION | | SEE PAGE |

| | | | | | | | |

| | | | | | | | |

| 1 | DIRECTORS: Election of directors | | | | FOR

each nominee | | |

| 2 | COMPENSATION: Advisory vote to approve named executive officer compensation | | | | FOR | | |

| 3 | PLAN AMENDMENT: Vote to approve the Amendment of the Equinix, Inc. 2004 Employee Stock Purchase Plan (the “Plan”), including to eliminate the Plan termination date | | | | FOR | | |

| 4 | AUDIT: Ratification of independent registered public accountants | | | | FOR | | |

| | | | | |

| EQUINIX 2024 PROXY STATEMENT | Proxy Summary / 3 |

Governance

Our Board of Director Nominees: 10 | | | | | | | | | | | | | | |

|

NANCI CALDWELL, AGE 66

(Independent Director) | | CHRISTOPHER PAISLEY, AGE 71

(Lead Independent Director) |

| | |

| Since: 2015 COMMITTEES: •Nominating and Governance •Talent, Culture and Compensation | | | Since: 2007 COMMITTEES: •Audit •Finance •Nominating and Governance •Real Estate |

| | |

| | |

ADAIRE FOX-MARTIN*, AGE 59

(Director) | | JEETU PATEL, AGE 52

(Independent Director) |

| | |

| Since: 2020

| | | Since: 2022 COMMITTEE: •Talent, Culture and Compensation |

| | |

| | |

GARY HROMADKO, AGE 71

(Independent Director) | | SANDRA RIVERA, AGE 59

(Independent Director) |

| | |

| Since: 2003 COMMITTEES: •Finance •Nominating and Governance •Real Estate | | | Since: 2019 COMMITTEES: •Talent, Culture and Compensation •Stock Award |

| | |

| | |

CHARLES MEYERS*, AGE 58(Chief (Chief Executive Officer and President) | | FIDELMA RUSSO, AGE 60

(Independent Director) |

| | |

| Since: 2018 COMMITTEE: •Stock Award | | | Since: 2022 COMMITTEE: •Audit |

| | |

| | | |

THOMAS OLINGER, AGE 57

(Independent Director) | | PETER VAN CAMP*, AGE 68

(Executive Chairman) |

| | |

| Since: 2023 COMMITTEES: •Audit •Finance •Real Estate | | | Since: 2000 |

| | |

*See “Proposal 1 - Election of directors” elsewhere in this proxy statement for information about a planned succession process after which time Ms. Fox-Martin shall be our chief executive officer and president, in addition to a Board member; Mr. Meyers shall be our executive chairman of the Board; and Mr. Van Camp shall transition to a special advisor to the Board. At this time, Ms. Fox-Martin is no longer considered to be an independent director.

| | | | | |

| EQUINIX 2024 PROXY STATEMENT | Proxy Summary / 4 |

Diversity and Engagement

| | | | | | | | | | | | | | |

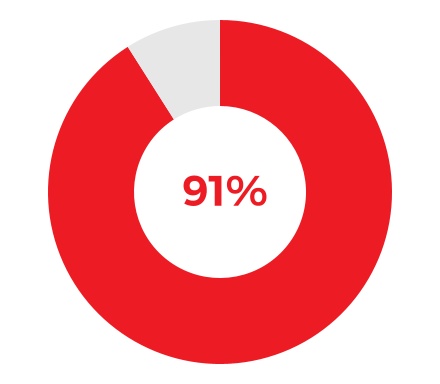

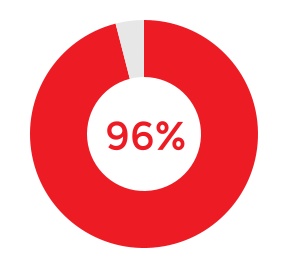

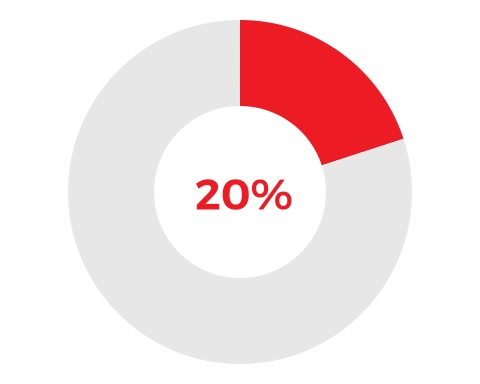

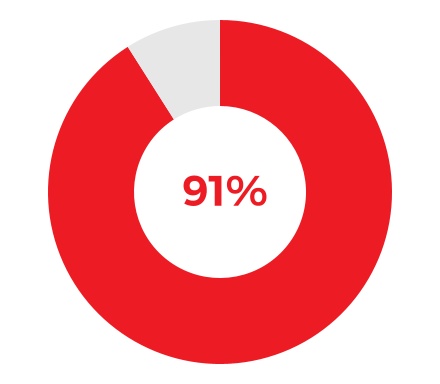

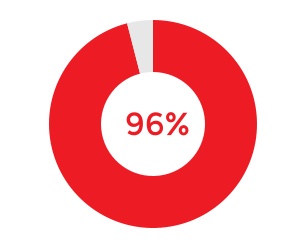

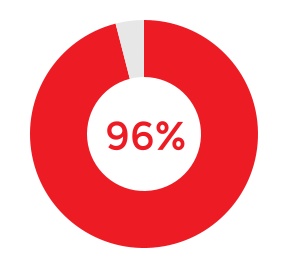

Board Nominees Who are Female | | Board Nominees Self-identifying as Racially/Ethnically Diverse | | Average Attendance at Board and Committee Meetings |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| 9.02 YEARS Average Tenure of Board Nominees as of Annual Meeting date •3 new members added in past 2 years •3 out of 4 newest members self-identify as female and/or racially/ethnically diverse | | | 8 Board Meetings in 2023

91% Average Attendance at

Board and Committee

Meetings | | | Board Committees •Audit •Finance •Nominating and Governance •Real Estate •Stock Award •Talent, Culture and Compensation | | | 2023 Meetings 9 4 5 8 0 4 | |

| | | | | | | | | | | |

Corporate Governance Best Practices

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| 1 YEAR Director Term | | | Majority Director Election Standard | | | No Supermajority Voting

Requirements | | | No Stockholder Rights Plan |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Stockholders Right to Call Special Meetings | | | Stockholders Right to Act by Written Consent | | | Stockholders Proxy Access Rights | | | Corporate Governance Materials |

| | | | | | | | | | |

| | | | | |

| EQUINIX 2024 PROXY STATEMENT | Proxy Summary / 5 |

Corporate Responsibility

| | | | | | | | | | | | | | |

| | | | |

| $4.9B | | $1.9M | | Executive Incentive |

| | | | | | | | | | | | | | | | | |

Renewable Energy Coverage Achieved

in 2023 | of Issued Green Bond Net Proceeds Fully Allocated Toward Eligible Green Projects | | in Employee Donations, Corporate Matching and Community-based Donations | | Short-term Incentive Performance Metrics for VP-level and Above Tied to Our Environmental and Social Progress |

| | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| 100% | | | | | | | | | | |

| | | | | | | | | | | |

| Clean and Renewable Energy Usage Target by 2030 | | | Nominating and Governance Committee Oversight of Environmental, Social and Governance (“ESG”) Initiatives | | | CEO Focus on Diversity, Inclusion and Belonging

Initiatives | | | Nominating and Governance Committee Oversight of Cybersecurity Program 1x per Quarter; Full Board Oversight at Least 1x per Year | |

| | | | | | | | | | | |

Performance and compensation highlights

Compensation Best Practices and Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | 206:1 | |

| | | | | | | | | | | | | | | | | | | | |

| Percentage of 2023 Executive Incentive Compensation Performance Based: 100% of Annual and 60% of Long Term | | | ESG Metrics Used for 2023 Incentive Compensation | | | Limited Tax Gross-Ups on Compensation | | | Stock Ownership Guidelines | | | Policy Prohibiting Hedging | | | Recoupment Policy | | | CEO Pay Ratio for 2023 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| EQUINIX 2024 PROXY STATEMENT | Proxy Summary / 6 |

Company Performance Underlying Incentive Awards

| | | | | | | | |

| REVENUES (in millions) | AFFO(1)/Share | STOCK PRICE PERFORMANCE(2) |

+13% | +9% | +20.41% |

| | |

(1)For a reconciliation of this non-GAAP financial measure to the corresponding GAAP measure, please refer to Appendix A of this proxy statement.

(2)Stock price performance from Jan. 1, 2021, to Dec. 31, 2023, including reinvested dividends of $44.11. Calculated using the 30-day trading average for EQIX on January 1, 2021, and December 31, 2023, the start and end of the performance period.

2023 Executive Compensation Mix(1)(2)(3)(4)

| | | | | | | | | | | |

| Chief Executive Officer | Average - Named Executive Officers | |

| | | |

|

(1)Average - Named Executive Officers chart excludes Mr. Meyers.

(2)Percentages may not sum to 100% due to rounding.

(3)Reflects the market value of the RSU and PSU awards on the grant date of Feb. 14, 2023, and target values with respect to the 2023 annual incentive plan and the performance based RSU awards.

(4)Annual incentives were paid in immediately vested RSUs in 2023.

| | | | | |

| EQUINIX 2024 PROXY STATEMENT | Governance / 7 |

Proposal 1 — Election of directors

All directors will be elected at the Annual Meeting to serve for a term expiring at the next annual meeting of stockholders and until his or her successor is elected, or until the director’s death, resignation or removal. If you sign your proxy card but do not give instructions with respect to the voting of directors, your shares will be voted for the 10 persons recommended by the Board. If you wish to give specific instructions with respect to the voting of directors, you must do so with respect to the individual nominee. If any nominee becomes unavailable for election because of an unexpected occurrence, your shares will be voted for the election of a substitute nominee proposed by the Board. Each of our director nominees currently serves on the Board and all were elected to a one-year term at the 2023 annual stockholders’ meeting.

Each person nominated for election has agreed to serve if elected and, except with respect to the planned succession process described below, our Board has no reason to believe that any nominee will be unable to serve.

The 10 directors who are being nominated for election by the holders of common stock to the Board; their ages as of Mar. 26, 2024; their positions and offices held with Equinix; and certain biographical information, including directorships held with other public companies during the past five years, are set forth below. In addition, we have provided information concerning the particular experience, qualifications,

attributes and/or skills that led the Nominating and Governance Committee and the Board to determine that each nominee should serve as a director of Equinix.

On March 7, 2024, as part of a planned succession process, the Board approved the appointment of Ms. Fox-Martin, a current member of the Board, as our new chief executive officer and president. The appointment will be effective on a mutually agreed date that is expected to be later in our second fiscal quarter, but no later than June 17, 2024 (the applicable start date, the “Transition Date”). Ms. Fox-Martin will continue to serve on our Board but shall no longer be considered independent.

Ms. Fox-Martin will succeed Mr. Meyers, who announced that he plans to retire as chief executive officer and president effective on the Transition Date. Mr. Meyers will continue with Equinix in the role of executive chairman, where he will continue in his service on the Board in addition to performing other advisory and transition services.

As part of this succession process, effective on the Transition Date, Mr. Van Camp, our current executive chairman, will resign from that position and from his service as a Board member, and will no longer be a voting member of the Board. However, he will continue to provide advisory consulting services as special advisor to the Board. Mr. Van Camp is standing for re-election to the Board in order to provide continuity in the executive chairman role through the Transition Date when Mr. Meyers will assume the role.

| | | | | | | | | | | | | | |

| | | | |

| | | | The Board recommends that you vote “FOR” the election of each of the following nominees. |

| | | |

| | | | | |

| EQUINIX 2024 PROXY STATEMENT | Governance / 8 |

| | | | | | | | | | | | | | | | | |

|

| NANCI CALDWELL | Independent Director / Since December 2015 |

|

AGE: 66 COMMITTEES: •Nominating and Governance  •Talent, Culture and Compensation

| | CURRENT ROLE •Corporate director (since 2005) PRIOR BUSINESS EXPERIENCE •Executive vice president and chief marketing officer, PeopleSoft (2001−2004) •Various senior and executive sales and marketing roles in Canada and the U.S., Hewlett-Packard (1982−2001) CURRENT PUBLIC COMPANY BOARDS

(in addition to Equinix) •CIBC •Procore Technologies, Inc. PAST PUBLIC COMPANY BOARDS •Talend •Tibco Software •Deltek •Donnelley Financial Solutions •Citrix Systems | | SKILLS & EXPERTISE •Executive leadership skills gained as an operating executive at major public companies •Deep “go-to-market” experience gained over decades of senior and executive enterprise sales and marketing roles at Hewlett-Packard and PeopleSoft, bringing insight to our strategy as we continue to target the enterprise customer and leverage our channel partner program •Global experience as an executive at multinational corporations •Experience with public company M&A •Risk management experience from prior operating roles as well as oversight expertise from experience gained across multiple boards and governance committees •Significant public company board experience across numerous boards |

| | | | | | | | | | | | | | | | | |

|

| ADAIRE FOX-MARTIN | Director / Since January 2020 |

|

AGE: 59 | | CURRENT ROLE •President, Google Cloud Go-to-Market (since 2023) and Head of Google Ireland (since 2021)(1) PRIOR BUSINESS EXPERIENCE •EMEA Cloud President, Google Cloud International (2021-2022) •Various roles, SAP (2008−Jul. 2021), including executive board member, global customer operations, president, chief operating officer, SVP industry business solutions, and vice president public sector •Various management roles, Oracle Corporation (1989−2007), the most recent being vice president government education and healthcare PAST PUBLIC COMPANY BOARDS •SAP SE | | SKILLS & EXPERTISE •Executive leadership skills gained as an operating executive at major public companies •Extensive experience in the information technology sector, bringing relevant technology expertise to the Board as we evolve our platform •Experience in cloud relevant to the Board as Equinix evolves our business model and strategy to meet the needs of our customers in a cloud-first world •Global experience as an executive at multinational corporations, and experience and perspective gained from living and working in both the Asia-Pacific and EMEA regions •“Go-to-market” experience in serving the enterprise customer, a key segment of our current strategy, as an experienced sales leader •Advocacy of social entrepreneurship and workplace inclusivity and fulfillment as founder of SAP One Billion Lives Ventures, relevant to our own ESG initiatives |

(1)See “Proposal 1 - Election of directors” elsewhere in this proxy statement for information about a planned succession process, after which time Ms. Fox-Martin shall be our chief executive officer and president, in addition to a Board member. At this time, Ms. Fox-Martin is no longer considered to be an independent director.

| | | | | |

| EQUINIX 2024 PROXY STATEMENT | Governance / 9 |

| | | | | | | | | | | | | | | | | |

|

| GARY HROMADKO | Independent Director / Since June 2003 |

|

AGE: 71 COMMITTEES: •Finance  •Nominating and Governance •Real Estate  | | CURRENT ROLE •Private investor PRIOR BUSINESS EXPERIENCE •Venture partner, Crosslink Capital, a venture capital firm (2002−2017) PAST PUBLIC COMPANY BOARDS •Carbonite | | SKILLS & EXPERTISE •Experience in the field of digital infrastructure services •Deep understanding of current technologies and trends, and implications for our strategic plans and positioning, through experience as an investor in the networking, cloud and infrastructure service sectors •Extensive capital markets and corporate finance experience, providing valuable insight to fundraising activities and to decisions regarding investments and allocation of capital •Public company board experience across numerous boards and valuable institutional knowledge and perspective gained from long tenure on the Equinix Board |

| | | | | | | | | | | | | | | | | |

|

| CHARLES MEYERS | Director / Since September 2018 |

|

AGE: 58 COMMITTEE: •Stock Award | | CURRENT ROLE •Chief executive officer and president, Equinix (since 2018)(1) PRIOR BUSINESS EXPERIENCE •President, strategy, services and innovation, Equinix (2017-2018) •Chief operating officer, Equinix (2013-2017) •President, Equinix Americas (2010-2013) •Various positions, including group president of messaging and mobile media, and product group executive for the security and communications portfolio, VeriSign, an Internet security company now part of Symantec (2006-2010) CURRENT PUBLIC COMPANY BOARDS

(in addition to Equinix) •Fastly | | SKILLS & EXPERTISE •Executive leadership skills gained as Equinix’s current CEO, and through various prior leadership roles at Equinix and other technology companies •Deep experience in the field of digital infrastructure services as well as in the technology and trends shaping Equinix’s current and future strategy •Global experience as an executive at multinational corporations •“Go-to-market” experience as an experienced sales leader •Experience with public company M&A, including multiple transactions while at Equinix •As Equinix’s CEO, responsible for setting and driving all aspects of ESG strategy, including award-winning sustainability initiatives and prioritization of DIB as a strategic priority; member of CEO Action for Diversity & Inclusion |

(1)See “Proposal 1 - Election of directors” elsewhere in this proxy statement for information about a planned succession process, after which time Mr. Meyers shall be our executive chairman of the Board.

| | | | | |

| EQUINIX 2024 PROXY STATEMENT | Governance / 10 |

| | | | | | | | | | | | | | | | | |

|

| THOMAS OLINGER | Independent Director / Since January 2023 |

|

AGE: 57 COMMITTEES: •Audit  •Finance •Real Estate | | CURRENT ROLE •Corporate director (since 2011) PRIOR BUSINESS EXPERIENCE •Chief financial officer, Prologis (2012−2022) •Chief integration officer, Prologis (2011-2012) •Chief financial officer, AMB (2007-2011) now a part of Prologis •Vice president, corporate controller, Oracle (2002-2007) •Audit partner, Arthur Anderson & Co. (1988-2002) CURRENT PUBLIC COMPANY BOARDS

(in addition to Equinix) •American Assets Trust | | SKILLS & EXPERTISE •Executive leadership skills gained as an operating executive at public companies, including as chief financial officer of Prologis •Global experience as an executive at a multinational corporation •Extensive capital markets and corporate finance experience providing valuable insight to decisions regarding investments and allocation of capital •Extensive experience with REITs and real estate development, including as a chief financial officer at a REIT, which provides valuable insight to discussions of Equinix’s continued expansion and management of our growing real estate portfolio •Experience with public company M&A •ESG experience through the oversight of financial and tax structuring efforts related to environmental sustainability transactions, and through the issuance and sale of green bonds, while chief financial officer of Prologis •Extensive finance and accounting expertise as a former chief financial officer, controller and audit partner, and as a current Audit Committee Chair •Risk management experience from prior operating roles •Public company board experience, including on another publicly listed REIT |

| | | | | |

| | | | | | | | | | | | | | | | | |

|

| CHRISTOPHER PAISLEY | Independent Director / Since July 2007 (and Lead

Independent Director since February 2012) |

|

AGE: 71 COMMITTEES: •Audit   •Finance •Nominating and Governance •Real Estate | | CURRENT ROLE •Dean’s executive professor of accounting, Leavey School of Business at Santa Clara University (since 2001) PRIOR BUSINESS EXPERIENCE •Chief financial officer, Enterprise 4.0 Technology Acquisition Corporation (2021−2023) •Senior vice president of finance and chief financial officer, 3Com (1985−2000) CURRENT PUBLIC COMPANY BOARDS

(in addition to Equinix) •Ambarella •Fastly PAST PUBLIC COMPANY BOARDS •Enterprise 4.0 Technology Acquisition Corporation •Fitbit •Fortinet | | SKILLS & EXPERTISE •Executive leadership skills gained as an operating executive at multiple companies, including as chief financial officer of 3Com •Global experience as an executive at a multinational corporation •Extensive capital markets experience •Extensive experience with public company M&A, including as an operating executive and as a board member •Extensive finance and accounting expertise as a former chief financial officer, as a current professor of accounting, and as an audit committee chair for numerous boards •Risk management experience from prior operating roles as well as from experience across multiple boards •Public company board experience across numerous boards and valuable institutional knowledge and perspective gained from long tenure on the Equinix Board |

| | | | | |

| EQUINIX 2024 PROXY STATEMENT | Governance / 11 |

| | | | | | | | | | | | | | | | | |

|

| JEETU PATEL | Independent Director / Since June 2022 |

|

AGE: 52 COMMITTEE: •Talent, Culture and Compensation | | CURRENT ROLE •Executive vice president and general manager of security and collaboration, Cisco (since 2021) PRIOR BUSINESS EXPERIENCE •Senior vice president and general manager of security and collaboration, Cisco (2020-2021) •Chief product officer and chief strategy officer, Box (2017-2020) •Senior vice president of platform and chief strategy officer, Box (2015-2017) CURRENT PUBLIC COMPANY BOARDS

(in addition to Equinix) •JLL | | SKILLS & EXPERTISE •Executive leadership skills gained as an operating executive at major public companies •Extensive experience in the technology sector, including SaaS application experience and operating experience managing SaaS, bringing relevant technology expertise to the Board as we execute against our digital transformation strategy •Experience in building both digital products through modern software development practices, and platform products with an emphasis on the developer persona, highly relevant to Equinix as we evolve our offerings and our platform to meet the needs of our customers •Global experience as an executive at multinational corporations •Extensive “go to market” experience including in (i) incubating and scaling non-core products via a core distribution model, (ii) Modern Marketing, and (iii) selling into IT, Security, Developer and Line of Business buying centers •Public company board experience across multiple boards |

| | | | | | | | | | | | | | | | | |

|

| SANDRA RIVERA | Independent Director / Since October 2019 |

|

AGE: 59 COMMITTEES: •Stock Award •Talent, Culture and Compensation  | | CURRENT ROLE •Chief executive officer, Altera, an Intel Corporation (since 2024) PRIOR BUSINESS EXPERIENCE •Various roles, Intel Corporation (2000-2023), including leading the network platforms group, chief people officer and most recently as executive vice president and general manager of Data Center and AI Group •General manager of CTI division, Catalyst Telecom (1998-2000) •Co founder and president, The CTI Authority (1996-1998) | | SKILLS & EXPERTISE •Executive leadership skills gained as an operating executive at multiple companies, including Intel •Extensive experience in the technology sector, including network infrastructure, 5G, data center, AI and cloud, bringing relevant technology expertise to the Board as Equinix executes against our platform strategy •Global experience as an executive at a multinational corporation •"Go-to-market" experience as an experienced sales and business development leader •Experience with public company M&A, including through numerous transactions while at Intel •Human capital and ESG experience, most recently gained as chief people officer of Intel, bringing insight to the Talent, Culture and Compensation Committee’s oversight of compensation plans and programs, and to Equinix’s diversity, inclusion and belonging initiatives •Public company board experience |

| | | | | |

| EQUINIX 2024 PROXY STATEMENT | Governance / 12 |

| | | | | | | | | | | | | | | | | |

|

| FIDELMA RUSSO | Independent Director / Since June 2022 |

|

AGE: 60 COMMITTEE: •Audit | | CURRENT ROLE •Executive vice president and general manager of Hybrid Cloud (since 2023) and chief technology officer (since 2021), Hewlett Packard Enterprise (HPE) PRIOR BUSINESS EXPERIENCE •Senior vice president and general manager of the Cloud Services business unit, VMware (2020-2021) •Various senior leadership roles, Iron Mountain, Inc. (2017-2020), including chief technology officer and executive vice president PAST PUBLIC COMPANY BOARDS •SBA Communications | | SKILLS & EXPERTISE •Executive leadership skills gained as an operating executive at major public companies •Extensive technology experience spanning servers, storage, networking, cloud services, backup, machine learning and analytics, global IT business services and infrastructure, relevant to Equinix’s digital transformation initiatives •Perspective of an Equinix customer, with a deep understanding of current technology trends, providing valuable input to our platform and product strategies •Global experience as an executive at multinational corporations •Human capital experience from leading large and diverse teams •Extensive experience bringing technology products to market •Experience with REITs as a board member of another publicly traded REIT •Public company board experience |

| | | | | | | | | | | | | | | | | |

|

| PETER VAN CAMP | Director / Since May 2000 |

|

AGE: 68 | | CURRENT ROLE •Executive chairman, Equinix (since 2007)(1) PRIOR BUSINESS EXPERIENCE •Interim chief executive officer and president, Equinix (Jan. 2018 - Sept. 2018) •Chief executive officer, Equinix (2000-2007) •President, Equinix (2006-2007) •President, UUNET, the internet division of MCI (formerly known as WorldCom) (1997-2000) PAST PUBLIC COMPANY BOARDS •Silver Spring Networks | | SKILLS & EXPERTISE •Executive leadership skills gained as Equinix’s CEO, and through various prior leadership roles •Deep experience in the field of digital infrastructure services •Global experience as an executive at multinational corporations •“Go-to-market” experience as an experienced sales leader •Experience with public company M&A, including 29 closed transactions at Equinix •Deep understanding of all aspects of ESG at Equinix •Public company board experience across numerous boards and valuable institutional knowledge and perspective gained from long tenure on the Equinix Board as Executive Chair, and as years served as Equinix’s CEO |

(1)See “Proposal 1 - Election of directors” elsewhere in this proxy statement for information about a planned succession process, after which time Mr. Van Camp shall transition to a special advisor to the Board.

| | | | | |

| EQUINIX 2024 PROXY STATEMENT | Governance / 13 |

Board composition

DIRECTOR SKILLS AND EXPERIENCE

Equinix is the world’s digital infrastructure company™. Digital leaders harness our trusted platform to bring together and interconnect the foundational infrastructure that powers their success. We enable our customers to access all the right places, partners and possibilities they need to accelerate their advantage.

Platform Equinix® combines a global footprint of International Business Exchange™ (“IBX®”) and xScale® data centers in the Americas, Asia-Pacific, and Europe, the Middle East and Africa (“EMEA”) regions; interconnection solutions; digital offerings; unique business and digital ecosystems; and expert consulting and support. We are investing in key strategic priorities to extend our competitive advantage, including investing in our people, evolving our platform and service portfolio, expanding our go-to-market engine, and simplifying and scaling our business. Our business is capital intensive, and frequent access to the capital markets has been a key element of our growth strategy. In addition, we have elected to operate as a real estate investment trust (“REIT”) for U.S. federal income tax purposes. Qualification for taxation as a REIT involves the application of highly technical and complex provisions of the Internal Revenue Code of 1986, as amended (the “Code”) to our operations and meeting recurring dividend obligations. And as innovation accelerates, so does the demand for resources to fuel our evolving digital world. We take seriously our responsibility to build sustainability into our business, and we actively work to face the world’s most important environmental challenges. We look to our Board to help us meet this moment.

In evaluating potential nominees for Board membership, the Board’s Nominating and Governance Committee considers qualification criteria such as independence, character, ability to exercise sound judgment, demonstrated leadership ability, and educational background and experience. The Nominating and Governance Committee also understands the importance and value of diversity on the Board. Both the Equinix, Inc. Board of Directors Guidelines on Significant Corporate Governance Issues (the “Corporate Governance Guidelines”) and the Nominating and Governance Committee Charter require the Nominating and Governance Committee to ensure qualified women and individuals from historically under-represented groups are included in the pool from which the Board nominees are chosen.

Finally, the Nominating and Governance Committee also considers the skills and experience of potential Board members in order to meet the current and anticipated needs of the Board and of Equinix as a whole.

Listed below are the skills and experience that we currently consider most valuable for our Board:

1. Executive Leadership

Directors with operating experience at large-scale and complex businesses bring valuable perspective and insights to our Board and offer guidance to Equinix’s leadership, as Equinix continues to expand in size and in reach, and as we evolve our strategy.

2. Digital Infrastructure Services

Equinix is a global digital infrastructure company. Board members experienced in this area bring the knowledge needed to understand our core offerings, along with our market opportunity, and provide input on our strategic vision in a developing and changing environment.

3. Relevant Technology Depth and Customer Perspective

As we innovate and evolve our existing products and develop new products and services for our platform, having relevant technology experience and an understanding of technologies impacting modern IT architectures on the Board provides valuable insight to management as Equinix executes against its platform strategy. In addition, as Equinix strives to “put the customer at the center of everything we do,” it is valuable for our Board to recognize and appreciate the evolving needs of Equinix customers. Board members who are experienced practitioners in digital transformation and/or have acted as trusted advisers to customers on this journey, including relevant experience in cybersecurity and information security, bring additional valuable knowledge to the Board.

4. Cloud/Software Domain Expertise

Our business model has evolved to pursue a platform strategy and take advantage of the rise in cloud computing and the changing needs of our customers as they transition to a cloud-first world. As Equinix seeks to benefit from these trends, related experience on the Board can inform our strategy.

| | | | | |

| EQUINIX 2024 PROXY STATEMENT | Governance / 14 |

5. Global Experience/Perspective

Equinix is a global company currently operating in 71 markets in 33 countries, and continuing to expand into new markets. The perspective that comes from living outside the U.S., or the on-the-ground operating experience one gains from running a global company, bring valuable business and cultural insights to the Board.

6. Human Capital

At Equinix, we recognize that attracting, developing and retaining talent at all levels is vital to continuing our success. We are striving to build a culture where every employee, every day, can say, “I’m safe, I belong, and I matter” and to develop our workforce to better reflect and represent the communities in which we operate. Our objective is to continue to make our culture a critical competitive advantage. Experience in managing people is thus a valuable asset on our Board.

7. Go-to-Market

Directors with deep “go-to-market” experience can provide expertise and guidance as we seek to grow revenues through our direct sales force and by leveraging our channel partner program. This oversight is also relevant to guide our brand building and marketing programs.

8. Capital Markets

Equinix’s capital needs for organic and inorganic expansion, alongside Equinix’s obligations as a dividend payer, lead Equinix to frequently access the debt and equity capital markets. This skill set on the Board provides valuable insight and perspective to these frequent financing transactions.

9. REITs/Real Estate Development

As Equinix has elected to be taxed as a REIT for U.S. federal income tax purposes, a Board member’s experience with operating within the REIT structure and maintaining REIT status brings valuable experience to inform the Board’s oversight in this area. In addition, Equinix is constantly evaluating opportunities to expand its extensive global real estate footprint and manage its portfolio. Experience in real estate development, expansion, acquisition and/or divestment, and in large-scale and long-term investments, offers valuable insight on our Board and provides key guidance to management.

10. M&A Experience

Equinix seeks opportunities for inorganic growth and has completed 29 acquisitions of complementary businesses since inception, including a number of cross-border transactions. A Board member with experience in M&A, including in evaluating proposed transactions and in post-acquisition integrations, provides valuable perspective and oversight as we seek to grow our business in existing and new markets.

11. ESG

ESG matters have taken on increasing importance to our customers, employees, investors and other key constituencies. Equinix is committed to protecting, connecting and powering a more sustainable digital world and greening our customers’ supply chains, and we are committed to best-in-class ESG practices including transparent measurement and reporting. A Board member’s experience in any aspect of ESG is extremely valuable to inform the Board’s oversight in this area and provide guidance to management.

12. Finance & Accounting

Experience in public accounting and preparation of financial statements is important to allow for effective understanding and oversight of Equinix’s financial reporting and its relationship with its auditors. Finance acumen and experience also add value to decisions regarding allocation of capital and investment strategies.

13. Risk Management

Experience in risk management, including in identifying, managing and mitigating enterprise risks, brings an important skill set to the Board to assist it in carrying out its oversight of operational, strategic, financial and regulatory risks, and to advise on engagement in any of these areas.

14. Public Company Board

Experience on multiple public company boards, or at least four years on our Board, offers valuable insight into board dynamics and operations, the interplay between the Board and the CEO and other senior leaders, the public company legal and regulatory landscape, effective oversight as a director, and Board best practices.

| | | | | |

| EQUINIX 2024 PROXY STATEMENT | Governance / 15 |

Below we have provided information in matrix form concerning the particular skills and experience which we consider our nominees bring to the Board. The directors’ biographies also reflect these skills from their experiences and qualifications.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| Skills & Experience | Nanci Caldwell | Adaire Fox-Martin | Gary Hromadko | Charles Meyers | Thomas Olinger | Chris Paisley | Jeetu Patel | Sandra Rivera | Fidelma Russo | Peter Van Camp |

| | | | | | | | | | |

| Executive Leadership | ü | ü | | ü | ü | ü | ü | ü | ü | ü |

| Digital Infrastructure Services | | | ü | ü | | | | | ü | ü |

| Relevant Technology Depth and Customer Perspective | | ü | ü | ü | | | ü | ü | ü | |

| Cloud/Software Domain Experience | | ü | | | | | ü | ü | ü | |

| Global Experience/Perspective | ü | ü | | ü | ü | ü | ü | ü | ü | ü |

| Human Capital | | | | | | | | ü | ü | |

| Go to Market | ü | ü | | ü | | | ü | ü | ü | ü |

| Capital Markets | | | ü | | ü | ü | | | | |

| REITs/Real Estate Development | | | | | ü | | | | ü | |

| M&A Experience | ü | | | ü | ü | ü | | ü | ü | ü |

| ESG | | ü | | ü | ü | | | ü | | ü |

| Finance & Accounting | | | ü | | ü | ü | | | | |

| Risk Management | ü | | | | ü | ü | | | | |

| Public Company Board | ü | | ü | | ü | ü | ü | ü | ü | ü |

| | | | | | | | | | | | | | | | | | | | |

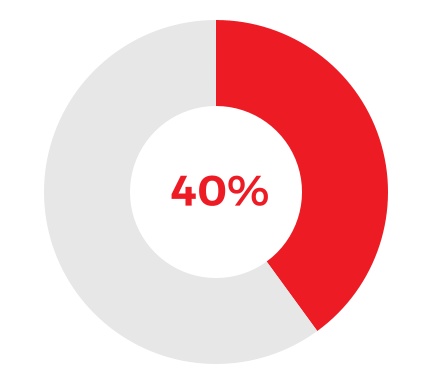

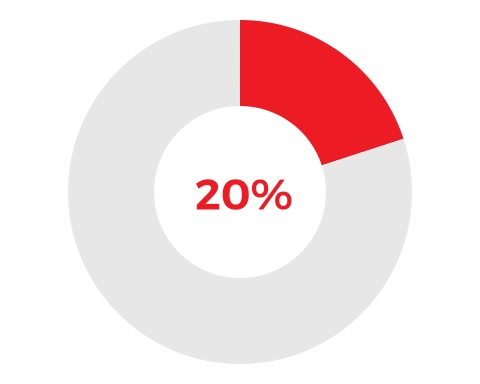

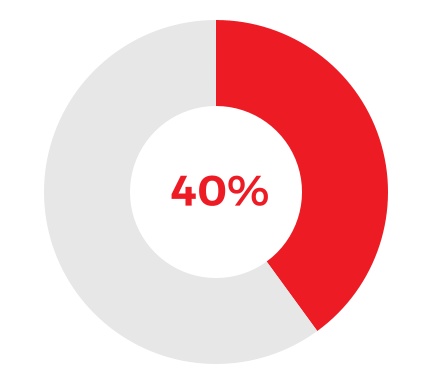

BOARD DIVERSITY, TENURE AND REFRESHMENT | 40% | | 20% | | 9.02 Years |

|

| | | |

Board

Female | Board

Ethnically

Diverse | | Average Tenure of Board Nominees •3 new members added in the last 2 years •3 of 4 newest members self-identify as female and/or ethnically diverse |

|

| | | | | |

| EQUINIX 2024 PROXY STATEMENT | Governance / 16 |

Our Board values and appreciates both the new ideas, perspectives and skills that newer directors bring to the Board, and the knowledge and experience gained over multiple years with Equinix that is brought to our Board by our longer tenured directors. The Board believes that a mix of tenures provides optimum oversight.

The Board also understands the importance and value of diversity on the Board. Both the Corporate Governance Guidelines and the Nominating and Governance Committee Charter require the Nominating and Governance Committee to ensure qualified women and individuals from historically under-represented groups are included in the pool from which the Board nominees are chosen.

Adding diversity to our Board has been a key priority in recent years, and three of our four most recently added directors have been female and/or racially/ethnically diverse. In early 2024, each member of the Board completed a self-identification survey with respect to diversity. If each director nominee is elected to the Board, our Board will include four women, and two of our Board members will be representatives of historically under-represented groups.

In addition, the Nominating and Governance Committee and the Board seek new Board members with experience relevant to our industry and current strategy. For example, in 2022, the additions of Mr. Patel and Ms. Russo were designed to add technological expertise to our Board, as we continue to evolve our platform strategy and product offerings, and in 2023, the addition of Mr. Olinger provided our Board with relevant REIT, real estate and financial expertise that were key skills needed on our Board. The skills matrix is a tool for the Nominating and Governance Committee to identify potential skill gaps and prioritize skill sets to consider adding to the Board.

While our Corporate Governance Guidelines do not limit the number of terms for which an individual may serve as a director, they do provide for, as an alternative to a term limit, a mandatory retirement age of 75. Our Board will continue to consider new Board members in light of all the factors above. The following table provides the self-identified diversity information of our Board nominees.

| | | | | | | | | | | | | | |

Board Diversity Matrix (As of April 12, 2024) |

| Total Number of Directors | 10 |

| Female | Male | Nonbinary | Did Not Disclose

Gender |

| Part I: Gender Identity | | | | |

| Directors | 4 | 6 | | |

| Part II: Demographic Background | | | | |

| African American or Black | | | | |

| Alaskan Native or Native American | | | | |

| Asian | | 1 | | |

| Hispanic or Latinx | 1 | | | |

| Native Hawaiian or Pacific Islander | | | | |

| White | 3 | 5 | | |

| Two or More Races or Ethnicities | | | | |

| LGBTQ+ | | | | |

| Did Not Disclose Demographic Background | | | | |

| | | | | |

| EQUINIX 2024 PROXY STATEMENT | Governance / 17 |

BOARD SIZE

Equinix’s Board currently consists of 10 directors. Equinix’s bylaws provide that the number of directors will be determined by the Board, and the number of directors is currently set at 10.

Thus, there will be not be any vacant seats on Equinix’s Board following the Annual Meeting, until Mr. Van

Camp’s expected transition off of the Board later in our second fiscal quarter as part of our planned succession process described elsewhere in this proxy statement. Proxies cannot be voted for a greater number of nominees than are named.

MAJORITY VOTE STANDARD

Our bylaws provide that a director nominee must receive a majority of the votes cast with respect to such nominee in uncontested director elections (i.e., the number of shares voted “for” a director nominee must exceed the number of shares voted “against” such nominee). If an incumbent director nominee fails to receive a majority of the votes cast in an uncontested election, the director shall immediately tender his or her resignation to the Board. The Nominating and Governance Committee of the Board, or such other committee designated by the Board, shall make a recommendation to the Board as to

whether to accept or reject the resignation of such incumbent director, or whether other action should be taken. The Board shall act on the resignation, taking into account the committee’s recommendation, and publicly disclose its decision regarding the resignation within 90 days following certification of the election results. If the Board accepts a director’s resignation, or if a nominee for director is not elected and the nominee is not an incumbent director, the remaining members of the Board may fill the resulting vacancy or may decrease the size of the Board.

Seven of the Board’s 10 current members are independent as such term is defined under the rules of the SEC and the listing standards of The NASDAQ Stock Market (“NASDAQ”). The Board has determined that all the Equinix director nominees are independent under such standards, except for

Mr. Meyers, Equinix’s chief executive officer and president; Mr. Van Camp, Equinix’s executive chairman; and Ms. Fox-Martin, who is expected to assume the role of Equinix’s chief executive officer and president later in our second fiscal quarter as described elsewhere in this proxy statement.

The Nominating and Governance Committee of the Board operates pursuant to a written charter and has the exclusive right to recommend candidates for election as directors to the Board. In addition to our Board candidates and incumbent nominees having the specific skills and experience identified above as valuable, the Nominating and Governance Committee believes that candidates for director should have certain minimum qualifications, including being able to read and understand basic financial statements, having high moral character, having business experience, and being over 21 years of age. Further, the Nominating and Governance Committee Charter requires the Nominating and Governance Committee to ensure qualified women and individuals from

historically under-represented groups are included in the pool from which the Board nominees are chosen.

The Nominating and Governance Committee’s process for identifying and evaluating nominees is as follows. In the case of incumbent directors whose annual terms of office are set to expire, the Nominating and Governance Committee reviews such directors’ overall service to Equinix during their term, including the number of meetings attended, level of participation, quality of performance, and any transactions of such directors with Equinix during their term. In the case of new director candidates, the Nominating and Governance Committee first determines whether the nominee must be independent for NASDAQ purposes,

| | | | | |

| EQUINIX 2024 PROXY STATEMENT | Governance / 18 |

which determination is based upon the Corporate Governance Guidelines, the rules and regulations of the SEC, the rules of NASDAQ, and the advice of counsel, if necessary. The Nominating and Governance Committee may then use its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The Nominating and Governance Committee will then meet to discuss and consider such candidates’ qualifications and choose candidate(s) for recommendation to the Board. The Nominating and Governance Committee will consider candidates recommended by stockholders. Stockholders wishing to recommend candidates for consideration by the Nominating and Governance Committee may do so in writing to the corporate secretary of Equinix and by providing the candidate’s name, biographical data and qualifications. The Nominating and Governance Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether the candidate was recommended by a stockholder.

Our bylaws provide for proxy access for director nominations by stockholders (the “Proxy Access Bylaw”). Under the Proxy Access Bylaw, any eligible stockholder, or eligible group of up to 20 stockholders, owning 3% or more of Equinix’s outstanding common shares continuously for at least three years, may nominate and include in Equinix’s annual meeting proxy materials for director nominees, up to a total number not to exceed the greater of 20% of the directors then serving on the Board or two directors, provided that the eligible stockholder or eligible group of stockholders and the director nominee(s) satisfy the requirements in the Proxy Access Bylaw. A more detailed description of the functions of the Nominating and Governance Committee can be found in the Nominating and Governance Committee Charter, published on the board & governance section of Equinix’s website at Equinix.com.

Board operations

BOARD LEADERSHIP STRUCTURE

From 2000 to 2007, Mr. Van Camp served as both our chief executive officer and as chairman of the Board. In Apr. 2007, Mr. Van Camp stepped down as Equinix’s chief executive officer but remained on the Board as executive chairman.

In Jan. 2018, Mr. Van Camp was appointed our interim chief executive officer and president. In Sept. 2018, Mr. Meyers was unanimously elected chief executive officer and president by the Board, and Mr. Van Camp resigned from these interim roles. Mr. Van Camp continues to serve as our executive chairman. Our chief executive officer is responsible for the day-to-day leadership of Equinix and its performance, and for setting the strategic direction of Equinix. Mr. Van Camp, with his depth of experience and history with Equinix dating back to 2000, provides support and guidance to management and to Mr. Meyers as executive chairman. He also provides leadership to the Board and works with the Board to define its structure and activities needed to fulfill its responsibilities, facilitates communication among directors and between directors and senior management, provides input to the agenda for Board meetings, works to provide an appropriate information flow to the Board, and presides over meetings of the full Board. Thus, while our chief executive officer is positioned as the

leader of Equinix and is free to focus on day-to-day challenges, our Board also has a strong leader with deep knowledge of Equinix in Mr. Van Camp. We believe this structure is best for both Equinix and our stockholders.

In Feb. 2012, Mr. Paisley was designated by the Board as its lead independent director. In this role, Mr. Paisley’s duties may include presiding at all meetings of the Board at which the executive chairman is not present; calling and chairing all sessions of the independent directors; preparing the agenda and approving materials for meetings of the independent directors; briefing management directors about the results of deliberations among independent directors; consulting with the executive chairman regarding agendas, pre-read materials and proposed meeting calendars and schedules; collaborating with the executive chairman and acting as liaison between the executive chairman and the independent directors; and serving as the Board’s liaison for consultation and communication with stockholders as appropriate, including on request of major stockholders. In addition, the number of independent directors on our Board and our committee structure provide additional independent oversight of Equinix. With the exception of the Stock Award Committee, all

| | | | | |

| EQUINIX 2024 PROXY STATEMENT | Governance / 19 |

committees consist entirely of independent directors. Our independent directors regularly hold private sessions and have direct access to management. A self-assessment of the Board is also conducted annually, at which time each member is free to evaluate and comment as to whether they feel this leadership structure continues to be appropriate.

As described elsewhere in this proxy statement, as part of a planned succession process, later in the second quarter of 2024, Ms. Fox-Martin shall become our chief executive officer and president, Mr. Meyers shall become our executive chairman, and Mr. Van Camp shall transition to a special advisor to the Board.

During the fiscal year ended Dec. 31, 2023, the Board held eight meetings, and our committees cumulatively held 30 meetings. For the fiscal year, each of the incumbent directors attended or participated in at least 75% of the aggregate of (i) the total number of meetings of the Board and (ii) the total number of

meetings held by all committees of the Board on which each such director served. In the event any director missed a meeting, that individual would separately discuss material items with Mr. Van Camp or Mr. Meyers.

The Board currently has six standing committees: the Audit Committee; the Finance Committee; the Nominating and Governance Committee; the Real Estate Committee; the Talent, Culture and Compensation Committee; and the Stock Award Committee. Special committees may also be formed from time to time.

The following table provides membership information for the incumbent directors for fiscal 2023 for such standing committees of the Board:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Committees | |

| Director | | Independent | | Financial

Expert | | Audit | | Finance | | Nominating and Governance | | Real

Estate | | Stock

Award | | Talent, Culture and Compensation | |

|

| Nanci Caldwell | | | ✓ | | | | | | | | | | | | | | | |

| Adaire Fox-Martin(1) | | | ✓ | | | | | | | | | | | | | | | |

| Gary Hromadko(2) | | | ✓ | | | | | | | | | | | | | | | |

| Charles Meyers | |

| | | | | | | | | | | | | | | |

| Thomas Olinger | | | ✓ | | | | | | | | | | | | | | | |

| Christopher Paisley(3) | | | ✓ | | | | | | | | | | | | | | | |

| Jeetu Patel(4) | | | ✓ | | | | | | | |

| | | | | | | |

| Sandra Rivera | | | ✓ | | | | | | | | | | | | | | | |

| Fidelma Russo | | | ✓ | | | | | | | | | | | | | | | |

| Peter Van Camp | | | | | | | | | | | | | | | | | | |

| Meetings in 2023 | | Board: 8 | | | | 9 | | 4 | | 5 | | 8 | | 0 | | 4 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Chairperson | | | | Committee

Member | | | | Executive

Chairman | | | | Lead Independent Director | | | | Audit Committee Financial Expert |

| | | | | |

| EQUINIX 2024 PROXY STATEMENT | Governance / 20 |

(1)Ms. Fox-Martin served on the Nominating and Governance Committee until Mar. 2024. Ms. Fox-Martin is no longer considered to be an independent director in connection with her planned succession to the role of chief executive officer and president.

(2)Mr. Hromadko served on the Audit Committee until Dec. 2023. Mr. Hromadko joined the Nominating and Governance Committee in Mar. 2024.

(3)Mr. Paisley served on the Nominating and Governance Committee until Jan. 2023 and then rejoined the Nominating and Governance Committee in May 2023.

(4)Mr. Patel served on the Nominating and Governance Committee until May 2023.

A detailed description of the Audit Committee can be found in the section entitled, “Report of the Audit Committee of the Board of Directors,” elsewhere in this proxy statement, and the Audit Committee Charter is published in the board & governance section of Equinix’s website at Equinix.com. The members of the Audit Committee in 2023 were Mr. Hromadko, Irving Lyons, Mr. Olinger, Mr. Paisley and Ms. Russo.

Mr. Lyons stepped down as a member of the Audit Committee in Jan. 2023, and left the Board following the 2023 Annual Meeting. Mr. Hromadko stepped down as a member of the Audit Committee in Dec. 2023. Mr. Paisley is chairperson of the Audit Committee and both Mr. Paisley and Mr. Olinger are considered financial experts. During the fiscal year ended Dec. 31, 2023, the Audit Committee held nine meetings.

The Finance Committee was established to assist the Board in fulfilling its responsibilities across the principal areas of corporate finance for Equinix. The Finance Committee provides oversight and assistance to management in considering such matters as Equinix’s balance sheet, capital planning, cash flow, financing needs, use of hedges and Equinix’s credit ratings agency strategy and discussions with such agencies. The Board has also delegated to the Finance Committee oversight of specific financing transactions. A more detailed description of the functions of the Finance Committee can be found in the Finance Committee Charter, published on the board & governance section of Equinix’s website at Equinix.com. In 2023, the members of the Finance Committee were Mr. Hromadko, Mr. Lyons, Mr. Olinger and Mr. Paisley. Mr. Olinger joined the Finance Committee in Jan. 2023, in anticipation of Mr. Lyons’s departure from the Board and Finance Committee in May 2023. Mr. Hromadko is chairperson of the Finance Committee. During the fiscal year ended Dec. 31, 2023, the Finance Committee held four meetings.

The Nominating and Governance Committee was established to (i) identify individuals qualified to become members of the Board, and select the director nominees for the next annual meeting of stockholders, (ii) review and consider developments in corporate governance practices and to recommend to the Board effective corporate governance policies and

procedures applicable to the company; (iii) review and consider developments related to the company’s Governance, Risk and Compliance program (the “GRC Program”) and to report to the Board on GRC Program activities and recommendations; (iv) regularly review the company’s cybersecurity risk exposure and mitigations to monitor and control such exposure; (v) receive periodic reports from the company’s chief compliance officer; (vi) oversee compliance with the company’s Code of Business Conduct; (vii) review and consider developments in corporate responsibility and report to the Board on activities and recommendations; (viii) provide oversight of the company’s public policy activities; and (ix) oversee the evaluation of the Board. A more detailed description of the functions of the Nominating and Governance Committee can be found in the Nominating and Governance Committee Charter, published in the board & governance section of Equinix’s website at Equinix.com. The members of the Nominating and Governance Committee in 2023 were Ms. Caldwell, Ms. Fox-Martin, Mr. Paisley and Mr. Patel. Mr. Paisley served on the Nominating and Governance Committee until Jan. 2023 and then resumed his position on the Nominating and Governance Committee following Ron Guerrier’s departure from the Board in May of 2023. Following the 2023 Annual Meeting, Mr. Patel left the Nominating and Governance Committee in order to serve on the Talent, Culture and Compensation Committee. Ms. Caldwell is chairperson of the Nominating and Governance Committee. During the fiscal year ended Dec. 31, 2023, the Nominating and Governance Committee held five meetings.

The Real Estate Committee reviews and approves capital expenditures in connection with real estate development, expansion or acquisition within parameters set by the full Board. Decisions are made considering a projected 10-year internal rate of return and within the context of a multiyear capital expenditure development pipeline and cash flow analysis provided by management to the Real Estate Committee. In approving and overseeing real estate capital expenditures, the Real Estate Committee also considers an overview of the project and the market, including the competition, strategy, current capacity and sales pipeline. In addition, the Real Estate

| | | | | |

| EQUINIX 2024 PROXY STATEMENT | Governance / 21 |

Committee has the authority to analyze, negotiate and approve the purchase, sale, lease or sublease of real property and approve guarantees related to real property lease transactions. A more detailed description of the functions of the Real Estate Committee can be found in the Real Estate Committee Charter, published in the board & governance section of Equinix’s website at Equinix.com. The members of the Real Estate Committee in 2023 were Mr. Hromadko, Mr. Lyons, Mr. Olinger and Mr. Paisley. Mr. Lyons left the Board and the Real Estate Committee following the 2023 Annual Meeting. Mr. Hromadko is chairperson of the Real Estate Committee. During the fiscal year ended Dec. 31, 2023, the Real Estate Committee held eight meetings.

The Stock Award Committee has the authority to approve the grant of stock awards to non-Section 16 officer employees and other individuals. In 2023, the members of the Stock Award Committee were Mr. Lyons, Ms. Rivera, and Mr. Meyers. Ms. Rivera joined the Stock Award Committee following Mr. Lyons’s departure from the Board in 2023. The Stock Award Committee typically does not hold meetings but acts by written consent.

The Talent, Culture and Compensation Committee provides oversight of human capital management at Equinix, including our strategies to attract, develop and retain talent at all levels; cultivate an engaged employee base; make our culture a competitive advantage; and promote workforce diversity, inclusion and belonging. The Talent, Culture and Compensation Committee also oversees succession planning for the CEO and select senior leaders. In addition, it oversees, reviews and administers all of Equinix’s compensation,

equity and employee benefit plans and programs relating to executive officers, including the named executive officers; approves the global guidelines for the compensation program for Equinix’s non-executive employees; and approves Equinix’s projected global equity usage. The Talent, Culture and Compensation Committee also acts periodically to evaluate the effectiveness of the compensation programs at Equinix and considers recommendations from its consultant, Compensia, Inc. (“Compensia”), and from management regarding new compensation programs and changes to those already in existence. The Talent, Culture and Compensation Committee is also consulted to approve the compensation package of a newly hired executive or of an executive whose scope of responsibility has changed significantly. A more detailed description of the functions of the Talent, Culture and Compensation Committee can be found in the Talent, Culture and Compensation Committee Charter, published on the board & governance section of Equinix’s website at Equinix.com and in the “Compensation Discussion and Analysis” section below. The members of the Talent, Culture and Compensation Committee in 2023 were Ms. Caldwell, Mr. Lyons, Mr. Patel and Ms. Rivera. Mr. Lyons was chairperson of the Talent, Culture and Compensation Committee until his departure from the Board following the 2023 Annual Meeting. Following the Annual Meeting and Mr. Lyons’s departure from the Board, Mr. Patel joined the Talent, Culture and Compensation Committee and Ms. Rivera became its chairperson. During the fiscal year ended Dec. 31, 2023, the Talent, Culture and Compensation Committee held four meetings.

BOARD RISK OVERSIGHT

Our Board’s oversight of risk management is designed to support the achievement of organizational objectives, including strategic objectives, to improve Equinix’s long-term organizational performance and to enhance stockholder value. The involvement of the full Board in setting Equinix’s business strategy is a key part of its assessment of what risks Equinix faces, what steps management is taking to manage those risks, and what constitutes an appropriate level of risk for Equinix. Our senior management attends the quarterly Board meetings, presents to the Board on strategic and other matters, and is available to address any questions or concerns raised about risk management-related issues, or any other matters. Board members also have ongoing and direct access to senior

management between regularly scheduled Board meetings for any information requests or issues they would like to discuss. In addition, in Sept. 2023, the Board held a multiday strategy meeting with senior management to discuss strategies, key challenges, and risks and opportunities for Equinix. The Board typically holds a meeting annually focused solely on strategy, to set the stage for the planning and development of Equinix’s operating plan for the coming year. In connection with this annual strategy meeting, the Board receives a detailed briefing from Equinix’s Enterprise Risk Management Program (the “ERM Program”), described further below. Additionally, each year, the Board receives at least one briefing from management on cybersecurity.

| | | | | |

| EQUINIX 2024 PROXY STATEMENT | Governance / 22 |